Depends.

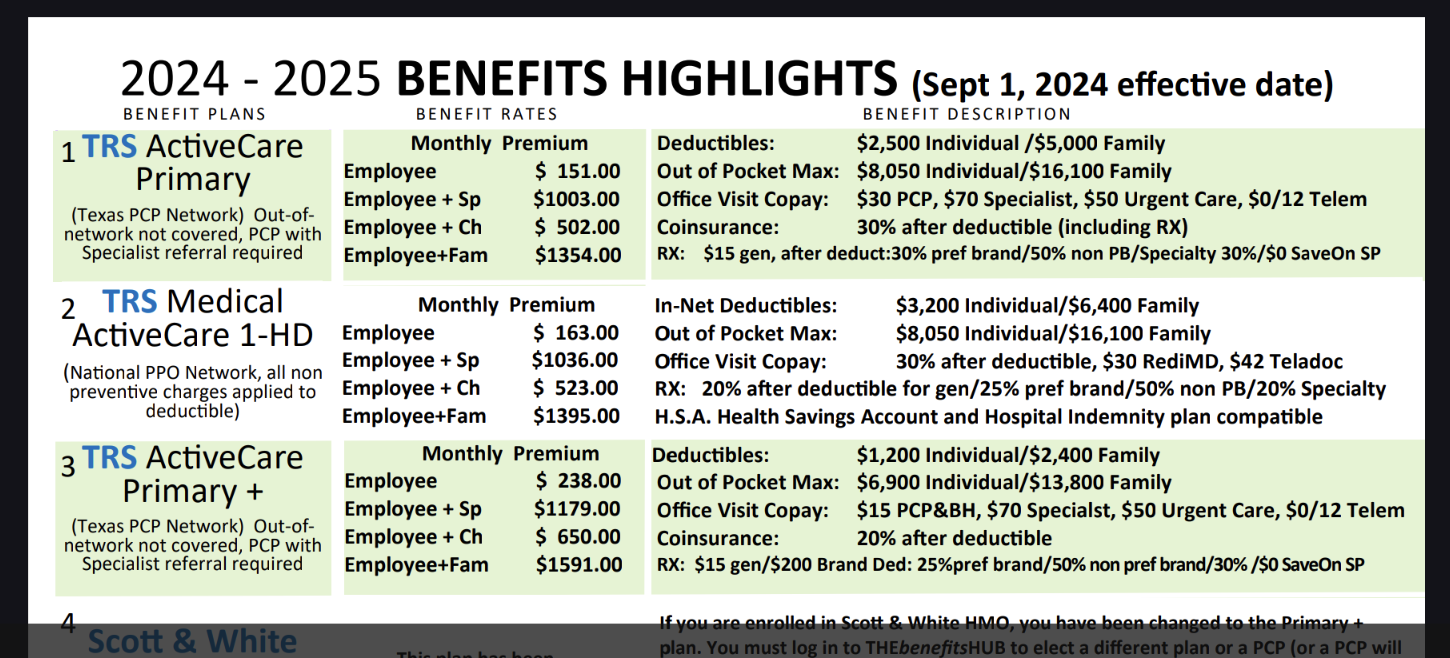

I pay $600/mo for insurance, mid-grade, without using it. Co-pays, medication, or any other medical procedures are all varying costs and extra out of our pockets. Some things are “free”, like vaccinations, and maybe some basic meds might be zero copay at the pharmacy, but it all comes out of the paycheck. Out of network doctor or specialist? Way more.

Things that are not covered are any extra insurance like long or short term disability. Long term care. Psych care. There are some things that cost extra, like ED visits, specialty treatments maybe like dental implants or hearing aids. We pay extra for some of these.

I have a good job, so does my spouse. The monthly costs are in the vicinity of $800 for a family of four, so $9,600 a year. They aren’t big costs, but nonetheless it’s money spent making some insurance company profitable gambling on my continued health. We also take money out of pay for what amounts to a pre-tax bank account that can be used for medical expenses only. You can pay for meds, dental visits, etc. with it. It’s pre-tax, so that’s great, but you don’t get to spend the money if you need it elsewhere.

It’s also all gone if I lose my job - the insurance is through my employer. Too sick to work? Gone. Injury and disabled? Gone. There’s no safety net except Medicare or -aid, and that’s a shitty plan that has all kinds of caveats like Medicaid can essentially take your home as “payment” in certain situations. Completely fucked up.

My insurance constantly gets more expensive and my services become more restricted every time my employer sees fit to reassess their insurance costs.

I would gladly pay a tax (or whatever they call it in countries that don’t call it a tax) in a more level paying field that isn’t tied to my job, that I have to choose what care or physicians I go to because of how much more it costs, or whether I should see a doctor, that doesn’t go to making some assholes rich based on whether or not I get a more costly or denied treatment.