Fuck all corpo scum! Intuit, TurboTax and H&R Block can all fuck right off! Corporate lobbying motherfuckers can burn in hell.

Technology

This is a most excellent place for technology news and articles.

Our Rules

- Follow the lemmy.world rules.

- Only tech related content.

- Be excellent to each another!

- Mod approved content bots can post up to 10 articles per day.

- Threads asking for personal tech support may be deleted.

- Politics threads may be removed.

- No memes allowed as posts, OK to post as comments.

- Only approved bots from the list below, to ask if your bot can be added please contact us.

- Check for duplicates before posting, duplicates may be removed

Approved Bots

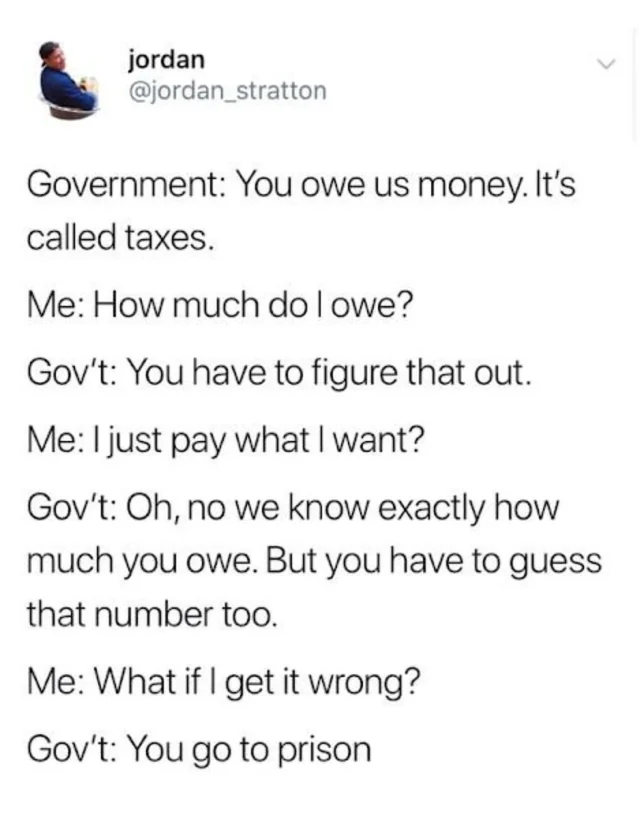

Old meme, but (1) you don't go to prison for making a mistake on your taxes in America — you have to do a big fraud (2) no, the government doesn't always know how much you owe, they only know stuff like domestic W2s and what banks file. There is a huge amount of ways to make income outside of that

I’m guessing 50% of individuals would be covered by just those 2 methods. Other methods would quickly follow once people realize how the rest of the world does not cater to crazy and the ones they can legally bribe (“lobby”).

Our captured Gov't: You go to prison...unless you're very wealthy of course, this is America after all.

Then we're happy to negotiate, settle, reduce, and otherwise facilitate your repayment in a way that's convenient for you and your tax litigation team, sir!

It's so weird to read a positive headline. :)

TurboTax for bankruptcy, LET'S GOOOOOOO!!!

Wait asking the states to allow this? Great means all the red states like the one I am stuck in will opt out fucking us over.

Usually they ask politely at first then 'ask' by threatening to pull interstate funding. (MADD or Common Core, for example)

Dark Brandon's war with TurboTax has only just begun...

It's kinda wild to see things moving in the right direction for once...

It's almost like, I don't know, Biden is helping. But both sides bad, amirite?

Carry on IRS, I would have zero issues using their tax return service. I'm certain the corporate tax return lobbyist are working overtime to prevent this.

Any takers on what party of small government will try to dismantle this?

You want a Biden TAX PANEL to decide if your grandmother has to pay or not? We will defend your right to choose the tax prep service of your choice!

Dearest American friends,

I'm happy for you. Given your tax system this seems like a really positive step forward.

I hope it makes your lives better.

Wild to read how the US tax system works when you're used to the EU.

Maybe one day you'll also get automatic tax filling without lifting a finger.

Fuck you Intuit. Ha, what're you going to do now? Sue the IRS?

Narrator: They will try.

Inuit lost like 16% this past week. That's a $113 drop per share for em.

My last attempt at efiling went real well right up to the efile step at which point the online service used demanded 17.00 for the priviledge. Ended up downloading, printing, and mailing it in.

Does this include state taxes?

The agency also is inviting all states with a state income tax to sign up and help people file their state returns for free. During the 2024 pilot, tax agencies in Arizona, Massachusetts, California and New York helped people directly file their state taxes.

I signed up to do the free IRS filing but got rejected unfortunately because I had entered into a domestic partnership which made me ineligible. Not really sure why since I was filing single anyway but oh well, this is good news and I can't wait to try it next year.

The test was limited to make sure the core fundamentals worked. Your situation is an "edge case," i.e an unlikely situation that makes things much harder to code.

It sounds like they cut you out to make sure the product worked, and will now be on working "edge cases," by far the hardest part of any computer engineering.

This is HORRIBLE! I absolutely can NOT stand ANYTHING that makes Biden look good!

-Republicans who care about the Economy and the Country.

WhAAAAATT! wow that is amazing great news. Holy shit!

I’ll be the contrarian - this could be good for Intuit.

They were already forced to support free filing for simple returns. This IRS Direct File has similar eligibility, so Intuit already wasn’t making money off them, but now Intuit also doesn’t need the cost of scaling up for them

Intuit gets to take a bunch of freeloaders off their support costs, and can focus where their real profits are: people with more complex returns or higher income, that also don’t need an accountant

Intuit also gets to act less scammy. The only way they were making anything off those freeloaders was selling them things they don’t need

They made money off upselling people who thought it would be free. Or another way was to wait to tell them about the charges until you've spent a couple hours on the application. ...or the way they would sell you last years tax information back to you to save you a few hours filling out forms.

United states of monetization.

How about return free filling.. Why the hell do we have to do anything at all?

I know how Intuit will respond: By lobbying to kill this.