this post was submitted on 16 Jan 2024

2521 points (97.8% liked)

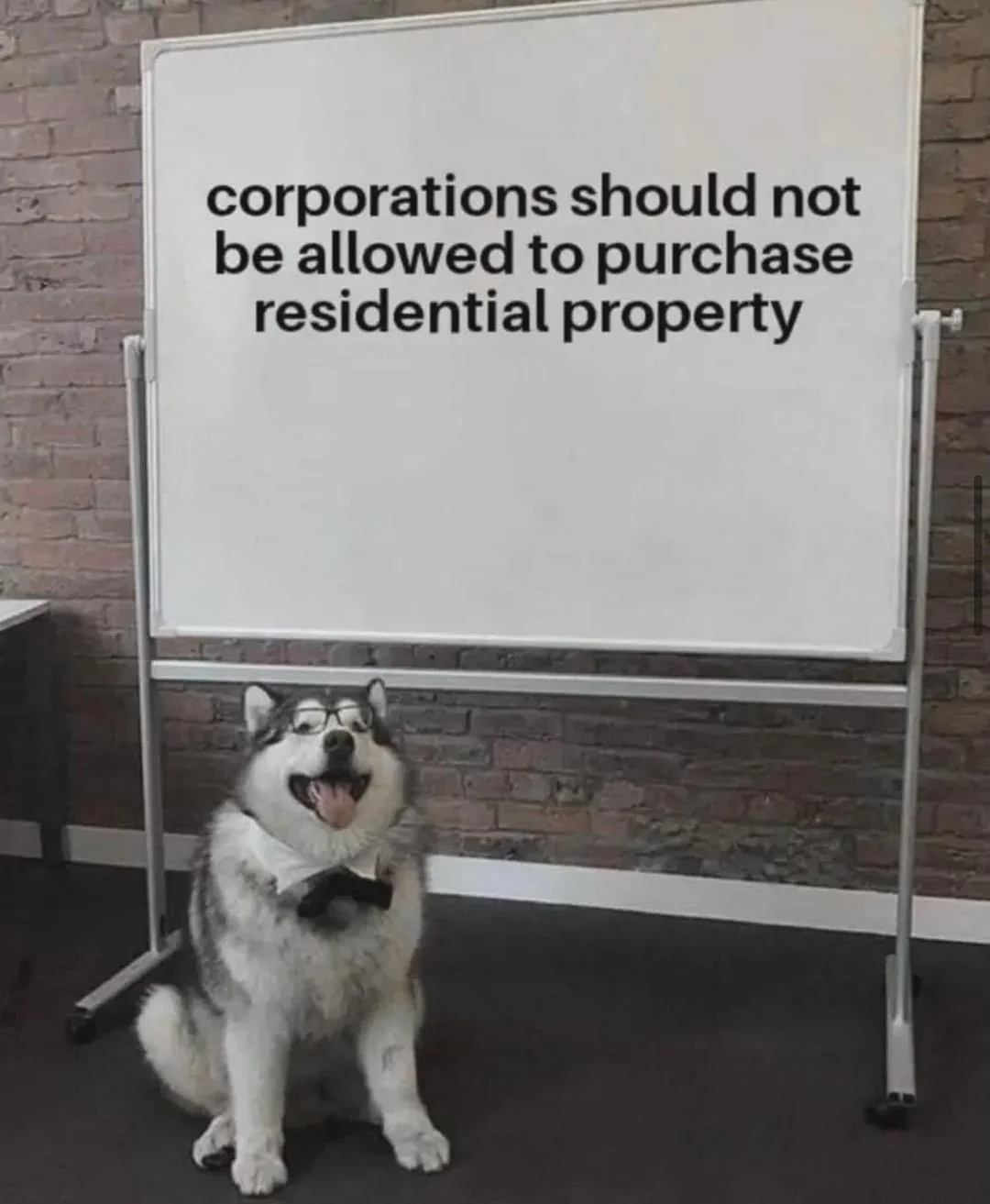

Memes

51003 readers

1414 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 6 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

No, no exceptions. Once there are exceptions people will abuse them. Even if you inherited your parents property if you already have one you should have to pay extra taxes on it from the day they die until the day you sell it, period. Any person, family, business, or corporation should only own one property, zero exceptions.

Edit: /S. Thought that was obvious

It can literally take years to sell a property even if you want to sell it. I don't think it's fair to penalize people who are unable to unload an asset and I also don't think it's fair to expect them to just give it away.

Added a /s. I should have in the first place. My b.

No problem. It's often hard to tell because of Poe's Law.

This seems needlessly callous to me. At least give them a 6-12 month period to clean up, do repairs, and sell the house. Not everyone that inherits a house is making enough to pay increased taxes right out the gate like you're proposing. Also, from personal experience, cleaning houses of deceased relatives tend to require a bit of work to get ready for selling and is incredibly emotionally draining. What you're proposing is going to be extremely painful for the people at the bottom, and emotionally wracking, since as soon as a loved one dies you're now under the gun to sell.

I agree though, second homes should be extremely heavily taxed. I just think we need to approach it with an even hand and make sure that we are targeting big corporate rental agencies and the very wealthy, and not some family that just lost their parents/grandparents. Something about targeting those people seems needlessly aggressive and not really the intention being discussed...

Yeah that's not far off from some folks' actual unironic opinions so the /s is unfortunately not obvious, lol. The Poe's Law situation isn't even hypothetical in this one.

Yeah, I realized that I should have known better.

Regarding the edit, I've seen people unironically post this take on lemmy.