this post was submitted on 02 Feb 2024

1896 points (96.5% liked)

Memes

49731 readers

2977 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 6 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Uh, yeah, after guzzling electricity like a small country, I'm sure bitcoin has massive scaling. Ability to process 9 transactions per seconds counts as massive scalability, right?

I assume you're speaking Bitcoin, cryptocurrency that uses Proof-of-Work consensus.

Proof-of-Work is very secure, super decentralized, but it's the culprit behind mining and subsequent electricity drain.

There are other consensus mechanisms, like Proof-of-Stake, to which Ethereum, Solana and many many others have migrated to or were based on to begin with.

Proof-of-Stake requires about 100x less electricity, is reasonably secure and is the default option for modern cryptocurrencies. Thereby the energy argument gets less and less relevant, while the fuss around it is only gaining speed.

Ethereum doesn't seem to have great TPS either ( ~15 transaction/s ), and talks about improving TPS seems to have quiet down.

You have something like Nano that hits around 50 TPS and also uses proof of stake. Transactions are basically instant and it has no fees. It was always my favourite in terms of crypto personally.

I think most eth-based transactions happen on different layers and then get settled on the main layer periodically. Same with Bitcoin, come to think of it. TPS doesn't seem like a particularly useful number these days.

Ethereum is a Layer-1, which is focused on super ironclad security and eternal preservation. It's more of a catalogue than a practical way to transact. Now, Layer-2's on the backbone of Ethereum (Polygon, Arbitrum, Optimism, etc.) are able to handle thousands of transactions per second.

For example, Polygon has a capacity to conduct up to 7200 TPS (while practically being used to the tune of 50 TPS simply because people don't actually need that much currently).

If you want Layer-1 that is focused on speed, there's Solana, for example, with 300.000 TPS tested and potential for 710.000.

This problem is essentially solved for everyday applications. The reason Bitcoin and Ethereum has such a low TPS is that they've never focused on TPS to begin with, instead opting for the most hyper-secure networks people store value in. I'm not saying Polygon or Solana aren't safe - they're perfectly fine - it's just that Bitcoin and Ethereum have laser-focused on that aspect, making compromising the blockchain even by biggest of institutions entirely off the table.

Whoa whoa whoa. I suppose you didn't get the memo:

but the rule is to blindly hate any kind of technology that any one has used in insalubrious ways, in-spite of its potential for liberation and independence.

When it shows that potential, maybe more people will get on board. Until then there are a host of problems that make a ton of people not want to touch it including but not limited to:

Capitalists and scammers are already exploiting it the way they do with traditional currencies, except in sometimes new creative ways because of either the lack of regulations or because the technology inherently makes it impossible to trace.

I don't see the involvement of predatory capitalists or financial institutions changing in a fully crypto world either, because people are always going to need financial services like loans and insurance on their savings and the financial institutions will always have the imbalance of power.

The currencies mostly benefit people with a ton of capital to handle consensus, which further entrenches the power imbalance found in (1) and (2).

Insane amounts of resources are needed to reach consensus in a way that is not good at all for the environment, whether that be electricity, computer hardware, or whatever other resource. Sure we already use a lot of power to make our society run. But crypto is asking for more ON TOP of that, compounding the issues. Saying the financial industry already uses a lot of power is not a good argument when I don't think anyone is reasonably convinced that they're going away even after crypto were to take over, and now you're adding an insane power or pollution requirement to run the world's currency system.

Relying solely on crypto leaves people destitute if their wallets got hacked, unless they decide to utilize traditional banking with insurance (hint: people like stability and a lot of people will choose to do this over having their life savings wiped out).

Chucklefucks are using the technology to commodify and break the best part of the digital world which is the ability to have bit for bit reproducible copies of information.

I'm serious. Fix all of that and you absolutely would get people on board. Not even kidding. Crypto would be taken seriously. But I have yet to hear compelling solutions by cryptobros.

I actually completely agree with all of your points. I also hold out hope for the decentralization of power, which is something I still think block chain and crypto have a role in. Its the same hope I have for the fediverse, that we can all 'own' or be a part of a broader solution through self hosting, development, and funding the projects we care about or think will make a difference.

I thought crypto had that potential, but because its looked at as 'money', the worst of the worst kinds of people steered its coarse. I still think the principals have this potential, and in more mature versions, I expect them to be realized. And arguably, they are being realized. In-spite of all of the shitcoins and scamcoins, bitcoin, the OG, is still extremely strong. I have no reason to believe that a bitcoin purchase made today wouldn't still be considered as good of an investment as SPY was 8 years ago. I also think the generally dismissive tone of the case against digital currencies as scam is a little hilarious, considering that literately 90%+ of stocks admitted to the NYSE end up with a similar if not worse fate than the majority of (major) coins from the big boom we saw through 2020. A few stocks stay valuable throughout time, but that's rare. Most end up valueless and eventually are delisted.

I think criticisms of digital currencies, especially decentralized ones, need to be put into the broader context of all financial vehicles that exist and are available. Likewise, crypto has potential outside of just digital currencies, and the insistence that its bad for the environment, well that's largely solved outside of bitcoin, and likely will never be solved for bitcoin. I still think its a neat technology with some interesting use cases. I've enjoyed watching it evolve and grow so far and I'm excited to by the belief that there is some potential for interesting things to come from that space in the future, especially if they support a more decentralized, anonymous, and democratic internet in the future.

Oh good Lord, I was partially inclined to agree but using generative Ai to make this point tells me everything I need to know.

If that's your make or break, go ahead and break. No real loss if that's your breaking point.

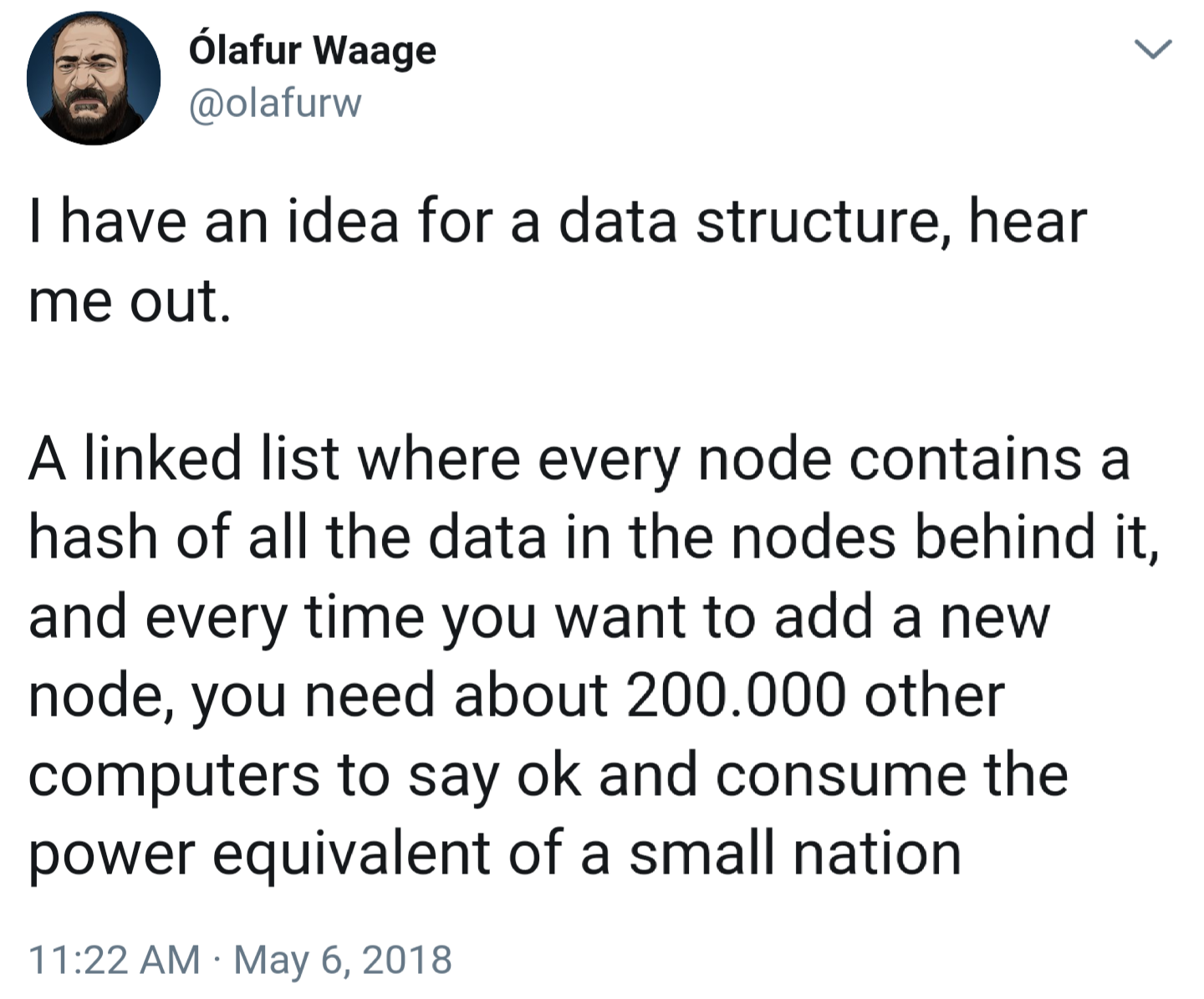

Couldn't even be assed to fix the text of the main focus of the picture?

I'm working bruh, how much time do you expect me to put into a throw away meme?

More that the barest minimum, at least.

Fine, Dad.

There I fixed it.